Money

Modest vs comfortable living in retirement

Writer Mark Dapin never gave much thought to money, but now he details what life would look like on Australia’s recommended retirement budgets.

By Mark Dapin

It seems that I need to prepare for a retirement that is either modest or comfortable, according to benchmarks set by the Association of Superannuation Funds of Australia (ASFA).

ASFA could be said to have skin in the game, since they want me to believe I will need a lot of money so that I will invest more with their members – but they might have a point.

I have never really thought about how much I will spend when I stop working, because I had assumed that I would cut my coat according to the cloth – just like I never, ever have done in my life.

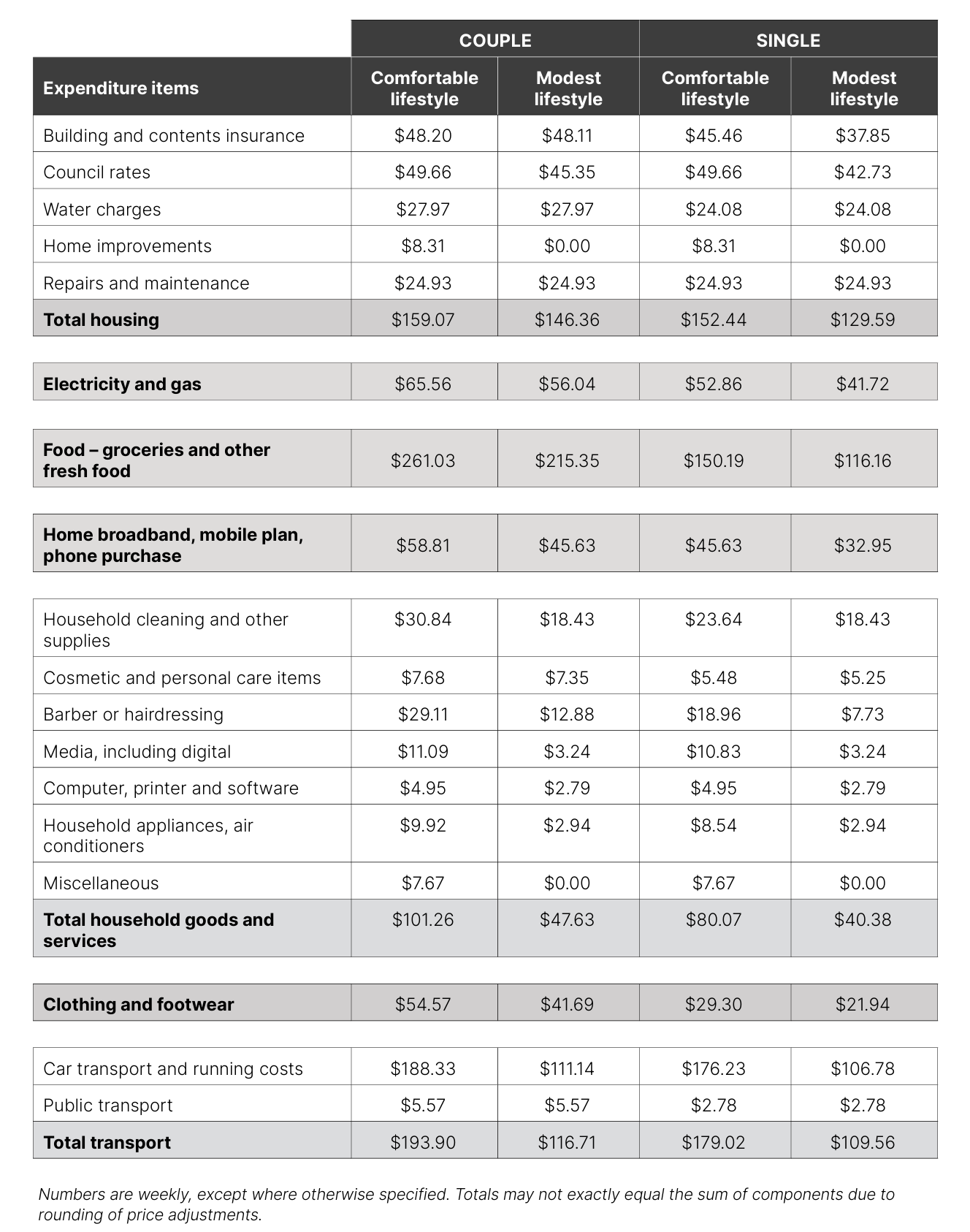

ASFA retirement weekly spending breakdowns

The “retirement standard” recently published by ASFA’s Research and Resource Centre, based on figures gathered in the first quarter of 2024, suggests that a retired couple aged 65-84 years old needs a joint annual income of $72,663.00 to live comfortably and $47,387.00 to live modestly.

This assumes that the couple will have already paid off their mortgage, which is a wild and unfounded assumption in my case.

Meanwhile, a single person can enjoy a comfortable retirement for $51,630.00, or exist modestly on $32,915.00

Conveniently, the ASFA provides “detailed budget breakdowns” for the weekly expenditure of retirees of each type. I looked at the figures for couples, with the perhaps optimistic idea that my relationship will survive my dotage.

The figures in each case assume that the retiree/s own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. All calculations are weekly, unless otherwise stated. See the extended breakdown of ASFA’s retirement standard for a full list.

ASFA’s overestimations… as according to Mark Dapin

ASFA’s estimates are meticulously itemised by expenditure categories, and there are some obvious savings to be made.

For example, a comfortable couple would spend $7.96 a week on home improvements. I’ll pocket that, for a start.

I hate home improvements, and I’m not sure I would have much trust in a builder who would work for $7.96.

That same comfortable couple would have $27.68 a week to spend on hairdressing, which is more than we spend today. And I cannot imagine that I will be growing more hair any time soon. Not on my head, at least.

The couple’s “car transport and running costs” come in at $189.49 a week. Since I have failed my driving test seven times, I am not worried about my half of that expense. The fact that I do not drive my own car has saved me a vast amount of money over the years, and is probably the only reason why I – along with any number of unfortunate people who might otherwise have tried to cross the road – remain alive today.

The comfortable couple’s spending on “TV/DVD” accounts for $1.21 a week. I am not sure anyone buys or rents DVDs anymore, and I suspect we’ll all end up watching “TV” on our computers and phones, so that’s another easy economy.

ASFA’s questionable underestimations

In other fields, however, projected spending seems to be vastly underestimated. ASFA has a category entitled “alcohol consumed or equivalent spent with charity or church”, as if drinking and piety were mutually exclusive.

A comfortable couple would spend $46.27 on drinking in a week, assuming that they gave nothing to charity during that same period.

Where I live, $46.27 buys you four schooners of beer – that is just two a week, each – although you would be left with $1.92 to put in the collection plate at church.

A modest couple would spend $26.16 on alcohol, which amounts to one schooner each. They might as well stay in. They certainly wouldn’t be advised to go out with their family, as any parent who has ever visited a bar with their adult children will know that they are expected to pick up the tab for everyone at the table.

A comfortable couple would spend $34.93 a week on overseas holidays (with which they might just be able to scrape one long weekend a year in Fiji) but $90.45 on domestic trips.

I guess this means I’ll be going on road trips and staying in motels while lunching at roadside bakeries with unlikely claims to serve “world-famous meat pies”, then having dinner at “Chinese and Australian” restaurants at country RSL clubs.

This is not really how I would define being ‘comfortable’, but at least I won’t have to do the driving.

But surely we get lots of holidays?

The modest couple does not take overseas vacations, perhaps because they overspend on their health insurance.

The comfortable couple pays $93.52 a week for health insurance, which seems steep, but even the modest pair pays $35.74.

Since only a little more than half of retirement-age Australians have private health insurance, that leaves just under half of the retired population living less than modestly, according to ASFA.

A cynic might suggest that the insurance business is not a million miles from the superannuation industry and the two sectors might have certain interests in common.

Things look up a bit after your 85th birthday. Your budget for overseas holidays drops to $0, for example, and car transport and running costs disappear even as a category. However, you spend a fair bit more on taxis and public transport, and the same amount on alcohol (or charity, if you’re becoming worried about your imminent place in heaven).

The (rock) bottom line…

The key number for ASFA – and, in fact, the point of the whole exercise – is the superannuation balance a couple will require on retirement at 67.

For those couples hoping to retire comfortably, this figure is $690,000. For a modest retirement, two people only need a total of $100,000. I think that this is because the age pension kicks in earlier for people who are less well off.

I am not sure what to make of any of this. But then, I am easily confused by long numbers.

One certainty is that it is cheaper to be bald than hirsute.

While this is good news for me, it is unlikely to be of much comfort to women.

I would prefer to live comfortably than modestly, both now and in the future. But I think I will have to work out my own spending requirements, because I do not believe that the couples imagined by ASFA actually exist.

I never see them in the pub, anyway.

At least you no longer need to buy clacky shoes

The idea of a couple using a joint annual retirement income of $72,148.19 to live “comfortably” involves a definition of comfortable with which I would be uncomfortable.

It’s realistic to expect to want to go out less frequently as you grow older, and it’s useful to bear in mind that you’ll no longer need to run up expenses that exist only because you have to go to work. You won’t be running a car to commute, or taking public transport on the same route every day (and, even if you do, your expenditure will be capped with a Seniors Card).

You won’t need to buy those terrible clothes that men in particular wear to the office – such as appalling light-blue check shirts that suit nobody, or shiny, clacky lace-up shoes. Women might not purchase so many cosmetics.

You won’t need work lunches or Kris Kringle gifts, but the savings probably end there.

It’s possible you’ll need more money to retire, not less

What the projection most glaringly fails to take into account is the fact that once you have paid off your mortgage, you will have to help your children buy their houses. Maybe you’ll sell up and downsize so that they can get into the market, but perhaps you’ll just, y’know, give them money as you always have done.

I don’t see a category for buying things for your grandchildren, either. I suspect this is a bigger (and more necessary) expenditure for many retired couples than a portfolio of insurance policies.

You might take fewer holidays, because you don’t have anything much to take a holiday from, but you’re going to want to stay in more comfortable places and, if you fly long haul, you might even consider buying business class seats.

Bearing all of this in mind, I suspect you might well need the same amount of money to live in retirement as before retirement. If not more.

Advice given in this article is general in nature and does not take into account your personal circumstances. It is not intended to influence readers' decisions about investing or financial products. They should always seek their own professional advice that takes into account their own personal circumstances before making any financial decisions.

You might also like: